Table of Content

Sure, you've lived there for a while, you know what's wrong with the house. But when was the last time you checked out the crawl space or the attic? You need to have these mechanical items, in addition to the plumbing checked out by a certified professional.

You'll need to know the details of your transaction before you sign ANYTHING. So, you've lived in your place for a year or two and your landlord has approached you about buying it. You really like your house and you want to stay there, and the prospect of homeownership is very exciting indeed! Before you jump on that chance, however, here are a few tips for navigating the process of buying the rental home you're in. This is especially true if your landlord won’t pay for your real estate agent.

CREDITSCORES

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. If you aren’t sure and want an expert opinion to make sure the process goes smoothly, you could hire an appraiser for under $400 in most areas to do a property valuation.

While a traditional mortgage is typically safer and more affordable than seller financing, not everyone will qualify. And there are select scenarios where seller financing could be a better alternative. In essence, a rent-to-own agreement allows you to build equity in a home you already occupy as a tenant without needing a mortgage loan. The best time to attempt a rental home purchase from your landlord is typically when the lease is up for renewal.

A Table Of Contents For Selling Property To Your Tenant

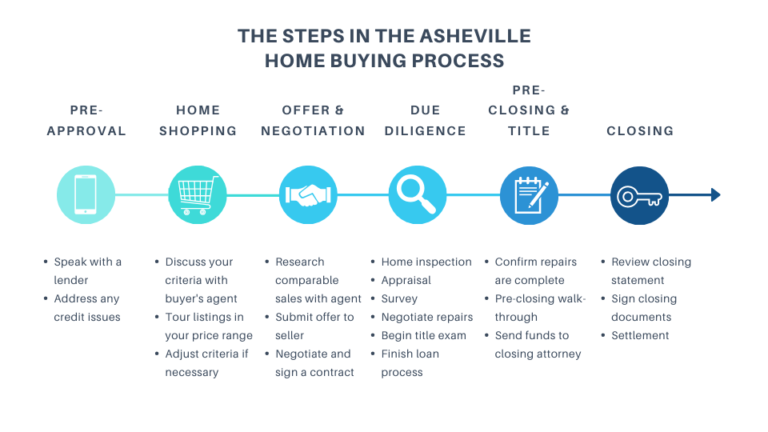

This will be safer and cheaper, in most cases, than alternative options like rent-to-own agreements. You might go the traditional route, by working up a purchase agreement and getting a mainstream mortgage loan. Or you and your landlord might agree on an alternative arrangement, like a purchase option or seller financing. Here’s what you should know about your options and how the process works. If you and your landlord agree on a purchase price and you are able to qualify for a mortgage, you may be able to set about buying the house immediately.

You still need to get a professional home inspection before you buy it, for sure, but living there means you know a ton about the condition the home. You MAY be able to negotiate a better price with your landlord. You already know the general condition of the house. FHA.com is a privately-owned website that is not affiliated with the U.S. government. They insure the FHA loans that we can assist you in getting.

Step 2. Hire Your Sales Team

A broker can also calculate your affordability and find out how much you could borrow. This information can help you to move forward with the process of asking to buy your rental home from your landlord, as you’ll have a better idea of how much you can offer. A mortgage broker with access to a range of UK and overseas lenders can compare the most suitable options on your behalf and will only recommend relevant lenders that are more likely to accept you. This can help you avoid possible credit rejections on your file and may also save you time and money.

Before you put a down payment on the property and hand over money to the landlord, you need to know what the fair market value of the house it. It makes absolutely no sense to pay more for a home than its worth. Read ahead for a no-nonsense guide to buying the home you rent from your landlord. “Owner financing can be a great idea when the interest rate the seller wants to charge is lower than the market rate and the terms are favorable to the buyer. For example, if the market rate is 7%, and the seller is offering owner financing at 5%, the buyer would be better off taking the owner financing,” suggests Haley.

You already know the commute times.

Another common complaint of new homebuyers is the house was in worse physical condition than they knew when the bought it. They had a lot of big, unexpected expenses after they bought the place. It’s expensive and it’s disruptive to the family, especially if you have kids and they would have to go to new schools. I’ve read that moving is the third most stressful thing in life, behind death in the family and divorce. Just the thought of moving makes some people put off buying homes. First, let’s look at the advantages to you, the tenant, the renter, the potential buyer.

Buying a home in the current market with buyers competing for the small number of homes on the market is intimidating for first time home buyers. If you are renting and you love the home you are already living in, don’t be afraid to ask for what you want. Reach out and we’ll connect you with a real estate agent to help you make it happen. If your landlord is offering to finance it for you, you need to ask a lot of questions. Keep in mind, most seller financing is for a short period of time, like 2-3 years, after which time, you will be required to obtain traditional financing through a bank or credit union.

When she’s not covering art, interiors, and celebrity lifestyles, she’s usually buying sneakers, eating cupcakes, or hanging with her rescue bunnies, Daisy and Daffodil. The worst-case scenario for a landlord is a tenant who becomes a tenant from hell. You won’t have the hassle and expense of getting the place ready for sale.

You can sell your shared ownership home at any time. An agent active in your area might have a better understanding of the market than an attorney, but an attorney can provide legal advice. Interview several and ask what services they will provide and at what price. In most cases, "a landlord is going to be more savvy about real estate than a tenant, who is likely to be a first-time buyer," says Janelle Boyenga, a broker with Intero Real Estate Services. You can call in agents of your own pretending to be the owner and ask them for a valuation.

Selling to a renter can be quicker than selling to almost anyone else. Your landlord will may be able to sell the house and pocket the money months sooner than if they tried to sell the house the normal way. If they sell to YOU, they MAY not have to pay any real estate agent commissions.

“A standard home purchase almost always involves a mortgage loan provided by a third party, such as a bank, credit union, or mortgage lender,” says Martin Orefice, CEO of Rent To Own Labs. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. We do not offer or have any affiliation with loan modification, foreclosure prevention, payday loan, or short term loan services. Neither FHA.com nor its advertisers charge a fee or require anything other than a submission of qualifying information for comparison shopping ads. We do not ask users to surrender or transfer title. We encourage users to contact their lawyers, credit counselors, lenders, and housing counselors.

In many cases, you will be able to find an attorney or a real estate agent that will handle the process for a flat fee. Depending on your budget for the transaction, you can make your choice about what type of team to assemble. Additionally, if you are unable to qualify for a mortgage after the designated time period, you will also forfeit your down payment money to the landlord. And some landlords who are near breakeven would lose money if they had to pay a 5, 6 or whatever percent in commissions to real estate agents.

No comments:

Post a Comment